by Laurie Pickard | Apr 12, 2014 | Courses, Platforms, and Profs

I’ve taken about a dozen business MOOCs so far as part of my effort to construct the equivalent of an MBA, for free. I’m always on the lookout for new courses, and I was excited when Coursera released “Financial Markets” with Nobel Prize-winning economist and Yale University professor Robert Shiller. I had previously come across another version of this course through Open Yale, a site run by Yale University where anyone can access no-frills video and audio of lectures that were delivered live in the classroom. I started the Open Yale lecture series but didn’t finish it because Coursera announced their version of the same course when I was only partway through. I generally prefer Coursera’s condensed, made-for-online format, so I stopped listening to the Open Yale lectures and signed up the Coursera version.

When I first got interested in MOOCs, I read several articles decrying MOOCs as furthering the phenomenon of “rock-star professors,” the idea being that big-name profs reduce the number of jobs available to lesser-known professors and diminish the quality of university teaching, since they typically teach to packed lecture halls where one-on-one interaction is practically impossible. Being an online student with no hope of actually speaking with my professors, I am excited about the idea that I might take a course from a renowned professor, even as one of thousands. Robert Shiller is about as renowned as they come. He basically predicted the 2008 financial crisis in his best-selling book Irrational Exuberance, and he won the Nobel Prize in Economics 2013, among many other career achievements.

Unfortunately, in its attempt to package Professor Shiller’s course for an online audience, Coursera missed an opportunity to use the MOOC format to surmount some of the obstacles inherent in teaching en masse. Instead, they managed to recreate many of the frustrations of a crowded lecture hall. Let me explain what I mean as we go through my three-part rubric for online courses.

Am I checking email during the video lectures?

This course passes the email test without a problem. Professor Shiller is clearly brilliant, the topics covered in the course are interesting and relevant, and the lectures are filled with history and anecdotes. However, the majority of the videos are the same lo-fi lectures I was watching on Open Yale, taken from when Professor Shiller taught this course in 2011. The sound quality isn’t great, the lighting is terrible, and the camera often pans away from the blackboard just as Professor Shiller finishes writing a formula. I often feel like a puny freshman in the back of the classroom, straining to see and hear what’s going on up front.

The best videos are the introductions to each week’s series of lectures, which Coursera produced specifically for this course. These videos are cheesy – each one features a different building on Yale’s illustrious campus – but the sound and lighting are good, and you don’t feel like an eavesdropper to a lecture that was made for someone else. These are also the videos in which Professor Shiller reflects on why, even with the bad image finance has acquired following the crisis, he still considers financial markets crucial to modern society.

Do the assignments require serious thinking?

The assignments for this course are composed of weekly quizzes and a peer-graded writing assignment. I was pleasantly surprised by the writing assignment, which required students to summarize an article about the psychological underpinnings of the financial crisis. The assignment was fairly rigorous, and peer grading worked better than I expected. It would have been even better if the peer graders had been able to provide written comments instead of just numerical scores, but that’s a minor complaint. The quizzes, however, are frustrating. They are certainly difficult enough, but they often test material that wasn’t adequately covered in class – for example, formulas that appear on the board for approximately 3 seconds before the camera follows Professor Shiller across the classroom and are never practiced. This is where Coursera was being lazy. Even if Professor Shiller himself was too busy to record new videos in which we could practice using these equations, surely one of the course’s three teaching assistants could have held a weekly section.

Is there a practical application for what I’ve learned?

I’ve mentioned before that I’m partial to courses that are short on theory and long on concrete skills. This course doesn’t exactly fall into that camp, but even though there isn’t a direct practical application for the material covered in “Financial Markets,” having an understanding of such markets is a necessary precondition for being an effective participant in them. This course will teach you what financial markets are, how they arose, and how they work today. Whether you are interested in using these markets, or just wants to have a better understanding of how they fit into our society, there is plenty of value to learning this material.

A missed opportunity

I think Coursera saw this course as a cash cow, an inexpensive way to turn pre-recorded lectures into a blockbuster MOOC featuring a star professor. They certainly built a lot of hype for the course; advertisements for it seemed to follow me around the web. But Coursera missed a chance to do more with the raw materials at its disposal. Any MOOC is a team effort. With Professor Shiller occupying the starring role, the rest of the team could have been called upon to flesh out the key concepts, just like in a live course where the big name professor is the draw and the TAs do the heavy lifting.

The bottom line

This course if definitely worth taking. Just don’t stress out about the math problems you can’t answer. Take this course to learn about the history and evolution of financial markets, to get a sense of the scope and purpose of these markets, to learn some terminology, and most importantly, to understand why an intellectual luminary like Robert Shiller thinks these markets are important to our society.

This post originally appeared on the website Poets and Quants.

by Laurie Pickard | Apr 6, 2014 | Thoughts on Higher Ed and Life

My focus in this semester is on finance and entrepreneurship. I started out strong with How to Build a Startup from Udacity. I also registered for several other courses, including Financial Markets with Robert Shiller (Coursera), Financial Analysis of Entrepreneurial Ideas (NovoEd), and An Introduction to Credit Risk Management (edX), as well as a few others. In registering for so many courses, I always thought I would drop some of them. I work full time, so I’m able to keep up with about two courses at a time.

One of the courses I signed up for as part of my finance and entrepreneurship unit – one I was actually quite excited about – was Evaluation Financière de l’Entreprise, a.k.a. Corporate Valuation, from the HEC business school in Paris (Coursera). As you might have guessed, this course was in French. Part of my interest in this course was the language element – I’ve studied French, I live in a formerly francophone African country, and I’m always looking for ways to improve my language skills.

But from the first week, it was clear that studying a difficult subject in a foreign language was going to require more time and energy than I typically budget for a MOOC. I spent the entire first video wondering what “action” the professor was referring to when he spoke about the “value per action” before realizing that “action” translates as “share.” I experienced a similar confusion with the word “bénéfice,” which translates not as “benefit” but as “earnings.” Unfortunately, by the time I had figured out that “benefit per action” was actually “earnings per share,” I had to go back and watch the whole lecture again.

The second week of the course, I went out of town over the weekend. Not having a large chunk of time that week to focus on my studies, I fell behind and I haven’t been able to catch back up. Even now that it has become abundantly clear that I won’t be able to finish the course, I haven’t been able to bring myself to un-enroll. Around 90% of MOOC enrollees don’t finish the courses they’ve signed up for. I’ve taken about a dozen MOOCs so far and this is the first one I’ve been unable to finish. Even though I didn’t intend to take all the courses I registered for, I’ve found it difficult to take the step of actually withdrawing from Evaluation Financière de l’Entreprise – I guess I don’t want to admit that I’m actually quitting, even if in practice I already have.

This experience has made it easier for me to understand why so many people don’t finish their courses. There is no cost at all to signing up, and registering for a course comes with a surge of hope and excitement about the new knowledge you’ll soon acquire. Giving up that prospect doesn’t feel good. Rather than subject oneself to the disappointment that comes with withdrawing from a course, it’s easier to let the course just time out. The fact that so many MOOC students are internationals, taking courses in their second or even third language, also helps to explain why the completion rates are so low.

My advice to other MOOC students at the beginning of this semester was to register for every course that strikes their fancy, then un-enroll from the ones they don’t plan to complete. Now that I’m actually in the position of knowing that I won’t be finishing one of my courses, I’ve found it difficult to take my own advice, but for the sake of consistency, I think I have to do it.

So here goes. Logging into Coursera. All right, Corporate Valuation, I’ll try to get back to you next time you’re offered.

Click.

<sigh>

It’s done.

by Laurie Pickard | Mar 29, 2014 | Thoughts on Higher Ed and Life

The No-Pay MBA’s big media break came in January of 2014, when an article that first appeared on the site Poets and Quants was syndicated to a few other websites and went viral on LinkedIn. But since then, I’ve done several other interviews with the media, resulting in some very thoughtful articles and blog posts. I’d like to direct your attention to a few of them, as well as to the new Required Reading page on this site, where I’ll continue to add articles that come out about my project, as well as articles about how MOOCs are changing higher education.

Most recently, the British publication Management Today profiled me and two other people who are using online courses to get a business education in an unconventional way. The article, titled “MBAs the alternative way,” explains why online courses and executive MBA programs might be a more cost-effective option for people with career ambitions that don’t fall narrowly within the scope of what MBAs typically do after graduation.

Also within the last week, the MOOC aggregator SkilledUp published an interview with me about how I’ve designed the No-Pay MBA and how it’s gone so far.

Nashville blogger Addison Cash posted a thoughtful piece on the No-Pay MBA in his blog Cashville Skyline.

Earlier this year, marketer and social media strategist Kat Macaulay interviewed me for her blog on the website Takcam.

The print newspaper Crain’s Chicago Business did a short piece on my project as an example of “How to make MOOCs work for you.”

by Laurie Pickard | Mar 9, 2014 | Community and Networking

I’d like to introduce two more people who have reached out to me since the last time I posted about other people who are using MOOCs to create MBAs. If you’re reading this and you’re doing the same, I encourage you to share your story with me. The two women I’m profiling below are both mid-career professionals, lifelong learners who have been finding ways to continue their educations since long before MOOCs became a thing. Read on for more information about how these women are using MOOCs to meet their personal and professional goals.

Name: Chiara Bersano

Name: Chiara Bersano

Country of origin: Switzerland

Lives in: California, USA

Age: 50

Chiara works in IT. She currently manages HR information systems for large corporations. She blogs at chiarabersano.blogspot.com.

“My life still doesn’t afford me the extra time to go back to school; and programs that I have evaluated tend to be exemplary for how they address other people’s need for development, but never seem to truly apply to me.”

“When I read an article about people using MOOC courses to build MBA-like programs at a fraction of the cost of a classic MBA [that’s this article about the No Pay MBA], I had an ah-ha moment. In fact, that was exactly what I had been doing all along, without thinking of formalizing it.”

“Here is my current, carefully culled list (but most likely not my final list… the great thing of such a plan is that it doesn’t have to stop!). Most of the time, I can’t manage more than two at the same time; but the most challenging part is toward the end, when deadlines multiply… I can add multiple courses, and drop out if it becomes too much - there is no penalty there.”

Courses Chiara has taken:

International Organizations Management, University of Geneva on Coursera

Globalization’s Winners and Losers, Georgetown University on EdX

Design Thinking for Business Innovation, University of Virginia on Coursera

Public Privacy, Universiteit Utrecht on Iversity

Designing and Executing information security strategies, University of Washington on Coursera

On-going course work:

Gamification, University of Pennsylvania on Coursera

Globalization of Business Enterprise, IESE Business School on Coursera

Wiretaps on Big Data, Cornell University on edX

The European Union in Global Governance, KU Leuven and Universität Passau on Iversity

Upcoming courses:

Introduction aux Droits de l’Homme, University of Geneva on Coursera

Organizational analysis, Stanford University on Coursera

Design Thinking, MHMK Macromedia University for Media and Communication on Iversity

The Changing Global Order, Universiteit Leiden on Coursera

Configuring the World, Universiteit Leiden on Coursera

La visione del mondo della Relatività, Università della Sapienza on Coursera

International Organizational Behaviour and Leadership, Università Bocconi on Coursera

Name: Michelle Krumholz

Name: Michelle Krumholz

Lives in: Chicago, USA

Age: 44

Michelle is a middle school science teacher for Chicago Public Schools, a position she has been in for 16 years and still loves. She’s also a mom of two teenagers and has been married for 22 years. Michelle is working on building a startup business centered around a website for teachers. The site itself is still under construction, but in the meantime you can follow her on Twitter @evolvededucator.

“I’ve always worked to pursue learning opportunities for the least financial commitment. Most recently I earned a math endorsement (21 hours) for free from the University of Chicago and an ESL endorsement (21 hours) from an online university for minimal cost. After I achieved five endorsements which directly improved my teaching skills, I decided it was time to broaden my scope of knowledge in order to build thinking skills for my students which will serve them during college and their careers.”

“When people ask why I’m pursuing an MBA, I reply why not? I’m learning about how our global economy works. I’m able to speak intelligently about business so I can communicate to my students what to expect and where to focus their thinking and efforts. Also, I’m truly interested in business. Besides teachers, everyone I know is in business. I like to be able to intelligently participate in conversations. I have everything to gain from learning a new skill set. Now that I’m pursuing this start-up venture, pursing an no pay MBA is a win scenario from every angle.”

Currently taking (all from Coursera):

What’s Your Big Idea? through University of North Carolina at Chapel Hill.

Financial Markets through Yale University and in about two weeks I’ll start

An Introduction to Operations Management through Wharton School of Business.

by Laurie Pickard | Feb 23, 2014 | MOOC MBA Design

I’ve written a lot about why I think I a MOOC-based MBA is a good idea for me. I already have a master’s degree, I live in a place where B-school isn’t readily accessible, I already work in the field I want to be in, I am building my network through professional contacts in my field, etc. But I realize that I haven’t made the financial case for the No-Pay MBA. I would like to take this opportunity to fix that.

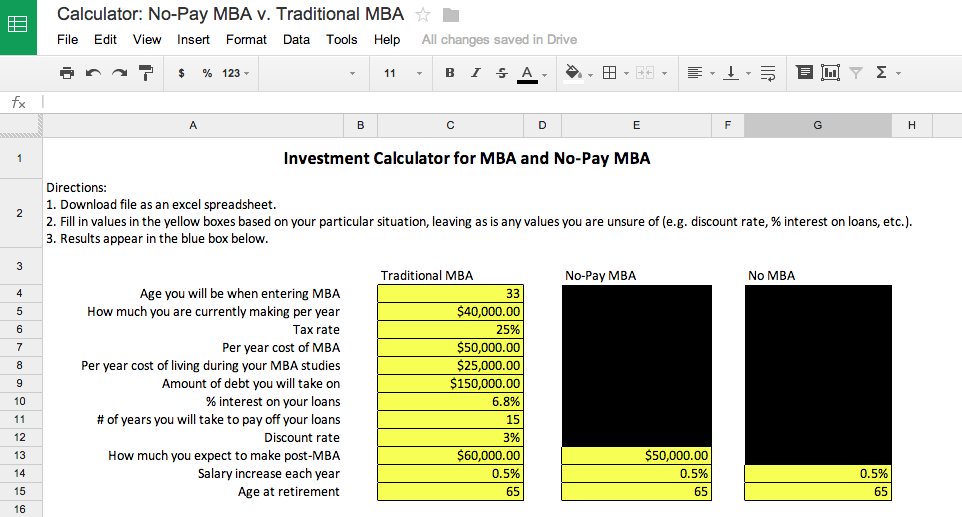

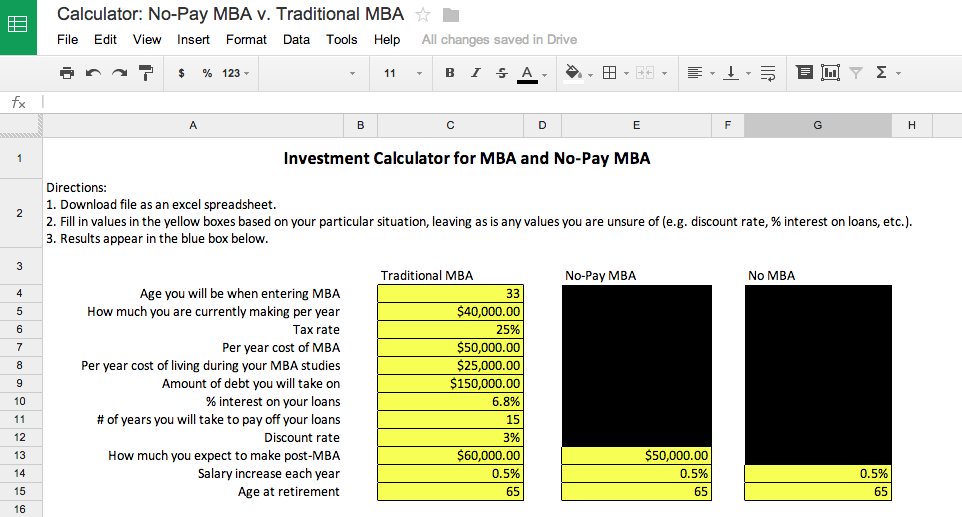

One of my themes this semester is finance, so it’s a good time to take a look at the financials for the No-Pay MBA. I have created a spreadsheet – what else do you do in finance? – to help me (and others) figure out how an investment in a No-Pay MBA stacks up next to an investment in a traditional MBA. I am making this spreadsheet available as a tool that anyone can use.

The spreadsheet can be found here: No-Pay MBA v. Traditional MBA Calculator

It looks like this:

For those who haven’t studied finance, let me explain how it works. In order to answer a question like “is an MBA a good investment?” you have to define the situation in which you will be investing in an MBA - are you a recent college grad with 30 years of work ahead of you, looking to go into a career in finance; or are you in your mid-thirties, working in non-profit administration, trying to get a leg up for your next position? These factors make a difference as to whether an MBA is a good choice for you or not. In the spreadsheet, the yellow boxes allow you to fill in details that reflect the particulars of your life and career situation. The spreadsheet has columns for three scenarios – traditional MBA, No-Pay MBA, and no MBA. I’ve blacked out the boxes that shouldn’t change from one to another. (Note: the spreadsheet won’t allow you to make changes within Google Drive. You’ll have to download it if you want to play around with it – which I encourage you to do!)

You can start with the simple stuff – your age, how much you’re making. For some of the items you’ll have to use a best guess or do some research – how much will the MBA cost per year, how much will you spend per year on living expenses, how much will you require in loans, etc. Any numbers that you’re really unsure about can stay as they are in the template. The numbers that appear there are my best guesses about things like the percentage one might pay on student loans – 6.8% - and the time it might take to pay them off – 15 years. Keep them as they are, or change them if you find better information.

How do you know what you’ll be making when you finish B-school? You don’t. But you can make an educated guess based on the starting salaries in the field you’d like to go into. The more accurate your guesses, the more accurate your final result will be. The same goes for the amount you’d make after a No-Pay MBA. Admittedly, there isn’t yet any information about how the market will value a MOOC MBA, so it’s probably prudent to make a conservative guess about how much you can increase your salary after such a course of study.

Also, bear in mind the assumptions I’ve made when making this spreadsheet. I’ve assumed that if you are doing a traditional MBA, it will take you two years, and you won’t be working during that time. For a No-Pay MBA, I’ve assumed three years (during which you will continue working) and $500 per year of incidental expenses associated with your coursework.

The one item you might not recognize is the discount rate. Basically, the discount rate is a way of accounting for the amount by which money loses value from year to year. Many of our grandparents have regaled us with stories about how much more valuable money was when they were kids. “I could buy ten candies for a penny! A dollar was really worth something back then.” Your grandfather is right. In 1940, his dollar could have bought 1000 candies. If he’d held on to that same dollar until today, he could probably only get about 25 or 50 candies with it. The dollar would have declined in value. That phenomenon is explained by the discount rate, and it is a very important consideration when evaluating any investment. For the purposes of the spreadsheet, I’ve set the discount rate at 3%, but you can change that as you wish.

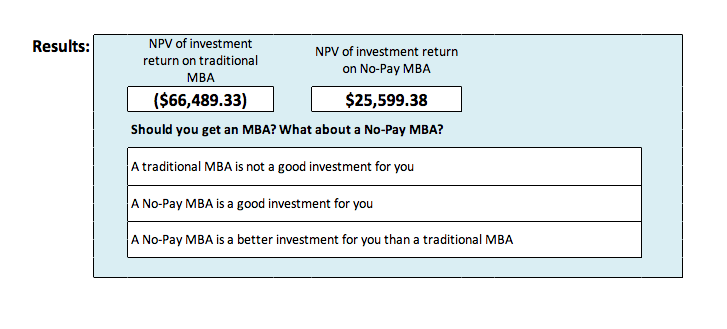

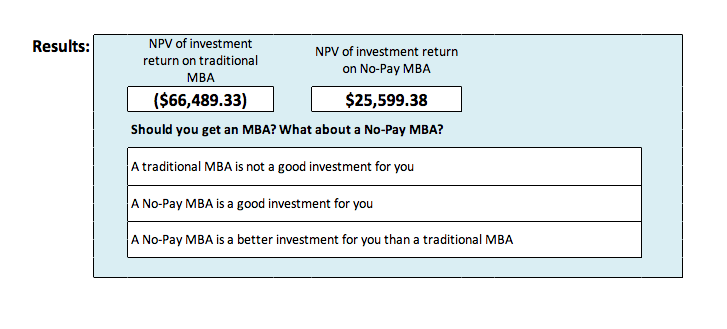

Once you’ve input all your information, scroll down to the bottom of the page. (The boxes that aren’t highlighted are there to do automatic calculations based on the data you entered, so don’t change them - unless, of course, you want to build a better calculator, in which case, be my guest!) At the bottom of the page you will see a box that looks like this:

What this is showing is the net present value of your investment return for both the traditional MBA and the No-Pay MBA. The scenario in which you get no MBA at all is serving as a baseline. In order to be worth investing in, the MBA would have to result in you earning enough over the course of your lifetime to offset the cost of the MBA, the interest on your loans, and the lost earnings during the time you spend studying and not working. If you see a positive number in the box for “NPV of investment return,” the investment is a good one. The greater the number in that box, the better the investment. Why NPV, you ask? That stands for net present value, and it factors in the discount rate, as explained above.

As you can see, for the person I’ve invented here (perhaps not so different from me), the traditional MBA is not a good investment. The No-Pay MBA on the other hand, is.